Germany is a country of insurances. There are lots of insurances. You will find insurance for almost everything in Germany. But neither all the insurances are mandatory nor all of them are important for you. Some of them are mandatory, for example, the health insurance (Krankenversicherung), if you own a car, then the liability insurance for car (KfZ Haftpflichtversicherung) etc. There are some insurances which are not mandatory but very important. Third Party Liability Insurance (private Haftpflichtversicherung ) is one of them. And there is another kind of insurances, which are not so important. For example, cell phone insurance or mobile phone insurance is not so important.

What is personal or third party liability insurance?

In Germany, if you cause damage to any third party (not part of your family) whether due to carelessness, mishap or forgetfulness, you must compensate the damage as per law. This compensation can come with enormous financial consequences. In the worst case, the person, who caused the damage can be held liable with their house and property, bank balance, wages and salary. Eventually this can lead to bankruptcy of the causing person.

To protect yourself and your family from financial ruin, you must have personal liability insurance or in another term third party liability insurance. Personal liability insurance insures personal injury, property damage and financial loss. This insurance comes handy against the financial risk that the person who caused the damage may face. Personal liability insurance is one of the most important insurances in Germany. Although it’s not mandatory by law, more than 83% Germans are insured with this insurance because of its importance. It’s even mandatory in some European countries.

Types and tariffs of liability insurance

For normal third party liability insurance, there are basically two tariffs:

- Single tariff: Only the policyholder is insured with single tariff. If you are a single person living independently, you can opt for this tariff.

- Family tariff: With family tariff, the insurance is extended to other people living in the same household. This tariff is especially suitable for married couples or people living in a marriage-like community. In most cases, the single tariff can be converted into a family tariff. Children are generally co-insured as long as they have not reached their 18th birthday. In some exceptional cases under some conditions, however, a child over the age of 18 can also be insured in the liability insurance.

Family tariffs are usually cheaper than insuring them individually for families and in civil partnerships living the same household.

Personal liability insurance only covers the private sector. You can also have professional liability insurance if you are work for other company, self-employed or freelancer.

There are also other types of liability insurances, which make sense depending on individual cases:

- Homeowners and landowners of rented or undeveloped property

- Animal owners , such as dogs and horses

- People in public service

- Hunter

When does personal liability insurance come forward?

When you make a claim to your personal liability insurance, it first checks whether your claim is justified or not. This insurance protects you comprehensively:

- If you, as an insurer ,consider the claim to be unjustified, you will reject the claims at your own expense and risk. Sometimes, liability insurance provides so-called “passive” legal protection. Don’t forget to check with your liability insurance whether they provide this kind of protection.

- If you consider the claims against you is justified, you will pay for the damage. The only prerequisite is that you haven not caused the damage intentionally.

There may be different types of scenarios depending on the damage, but the basic rules are as the following:

- Property damage: Usually, the repair costs are paid in case of property damage. If the property loses its value because of the repair, you may also claim the surcharge for this depreciation.

- Total loss: If the property or item is not usable anymore (Totalschaden), the current value of the property or item will be taken into account. For example, if you break a used television at your friend’s place, your friend would receive enough money so that he can buy a similarly good, used television.

- Personal injury: Things can become very complicated and expensive in the event of personal injury. If you cause any physical injury to anyone, your liability insurance will kick in with the medical and hospital costs, costs for any mental or psychological suffering, compensation for any professional damage, compensation for being fit to work, compensation for any permanent damage (e.g. pension payments), compensation for care insurance in the given cases and so on. If you don’t posses liability insurance, this personal injury case can make you and your next generation bankrupt.

The amount of insurance coverage

For every liability insurance, there is a limit up to that sum the insurance company will cover. If the damage is higher than the actual insurance sum, the insurance will not pay the rest. Typically, you should make sure you have sufficient insurance. The insurance should cover at least 15 million euros all three areas discussed above, which are:

- personal injury

- property damage

- financial loss.

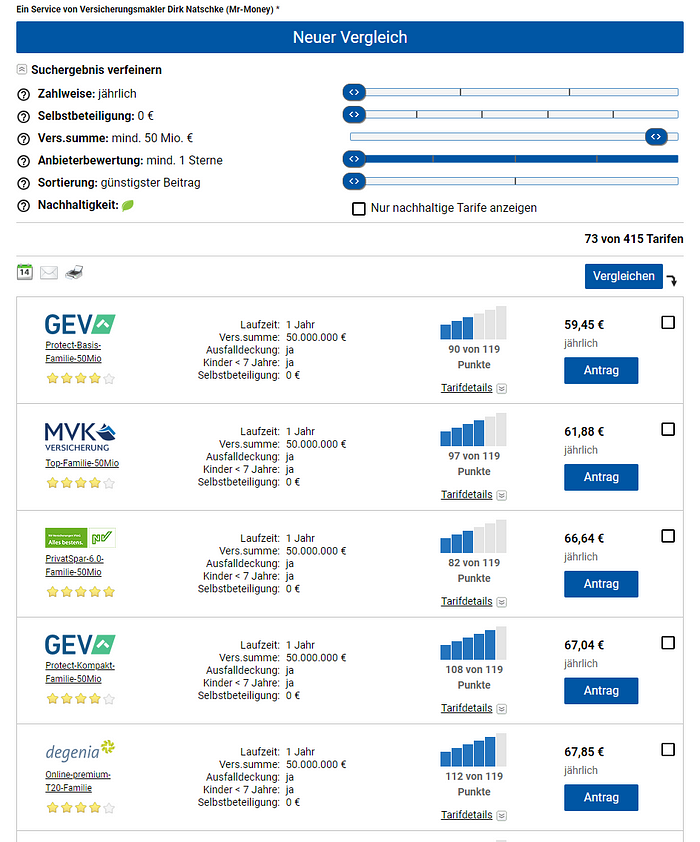

The more the sum of the coverage the better. As fundamentally the premium for a liability insurance is anyway not high, coverage amounts of around 50 million euros are better and you can increase the coverage up to this by just paying a few euros more.

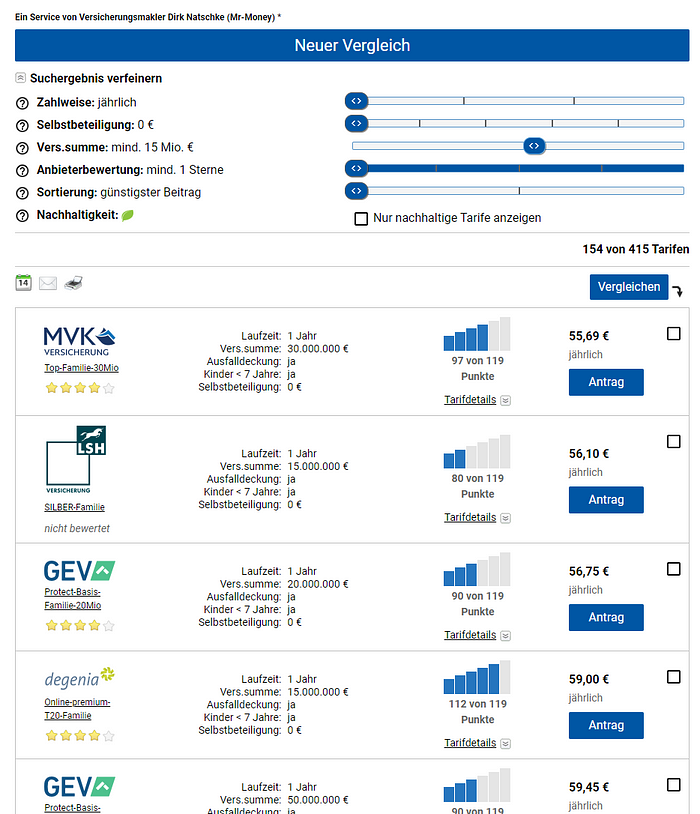

We can quickly compare how much the premium increases, if the coverage sum is increased from 15 million euros to 50 million euros through tariff check comparison portal.

15 million euros coverage cost:

50 million euros coverage cost:

As you can see from the comparison, you may have to pay only a few euros extra, if you want to increase your coverage from 15 million to 50 million. If you want to perform this comparison for your case, you can do so with by clicking on this tariff check link.

What is insured?

There are so many things, which are insured under personal liability insurance. Usually, under any personal liability insurance, you are insured:

- as a pedestrian or cyclist (also even you have electric bicycles) in road traffic

- in case of negligence of the minors supervision duty (both for your own children and the children of the others)

- as the temporary inhabitant of owner-occupied real estate (holiday apartments, holiday house, hotel room etc.)

- in the event of damage caused by your own or someone else’s rowing and paddle boats, surfboards or someone else’s (borrowed or rented) sailing boats

- as a participant in private sporting activities such as football, badminton, tennis etc.

- for the loss of someone else’s private apartment key or business key

- for damages resulting from the exchange, transmission and provision of electronic data (some really old liability insurance might not have this covered)

- in the event of violation of traffic safety obligations (e.g. cleaning, gritting and snow cleaning on sidewalks)

What is not insured?

There are some cases, which are often misunderstood to be covered. But they are actually not covered. For example:

Favors : If you help others at their request (move, for example) and in doing so cause damage through simple negligence, you are generally not liable for damages. You should discuss such courtesy services with the other party beforehand and, if necessary, look for suitable insurance, that cover this case.

Incapacitated Children : Children, who have not yet reached their 7th birthday cannot be held responsible under the law for damages. That means, any damage caused by the children below 7 years is not insured. In the event of damage caused by moving traffic, children are only responsible from the age of 10. If the parents have not neglected their duty of care, the injured party will not receive any compensation. Good news is that there are so many liability insurances in Germany, which also insure incapable children.

Moreover there are also some cases, where you liability insurance does not step in. For example:

- Liability when driving or in motion (duh), which is instead covered by the mandatory car insurance (Kfz-Haftpflichtversicherung)

- Damages to the items in your home, which are covered by a content insurance (Hausratsversicherung)

- Situations where family members accidentally injure each other or themselves, which is instead covered by an accident insurance (Unfallversicherung)

- Damages related to your job, workplace, volunteer work, or company, because they are usually already insured by your employer.

- Extreme sports or risky hobbies

- Fines and penalties, damages resulting from criminal offences

- Intentionally caused damage

- Damages due to breach of contractual obligations

An important clause to watch out for

If you are harmed by someone, who does not have liability insurance and cannot pay for the damage themselves, it is important that your liability insurance company steps in and pays you for the damage. When you look for a liability insurance, you should definitely make sure that your liability insurer has coverage for these cases.

When is insurance coverage at risk?

In the event of liability damage, you may not recognize the claim of the injured party or pay compensation without the written consent of the insurance company. So don’t sign an acknowledgment of guilt and don’t pay any money. Otherwise, this can jeopardize your insurance cover. As it is for many other insurances in Germany, you must report the damage to your insurance company immediately.

Is liability insurance valid worldwide?

Mostly, the private liability insurance is valid worldwide. As a rule, however, the stay abroad must not last longer than one year. However, within the European Union, there should not be any time limit. Don’t forget to make sure that this is mentioned in your contract.

Contract termination

If you have not agreed a term for more than one year, you can usually terminate the contract three months before the end of the insurance year. Notice of termination should be in writing and sent by registered mail so that you can provide evidence of compliance with the deadline if necessary. Details on the notice periods for your liability insurance can be found in your contract.

Usually, you also have special right to cancel in the event of a claim or if the premium increases.

How to choose a suitable insurance company and tariff in Germany

There are so many insurance companies in Germany. The differences in contributions and benefits among the providers of private liability insurance also vary enormously. It’s always a good idea to compare the avaible insurances in the market by comparison portal like tariff check24. Sometimes, it is a good idea to talk to an insurance agent. If you want, you can also book an appointment with me and then together we can look for the best liability insurance for you. Currently, I’m insured with Getsafe liability insurance, which provides support and documentation in English too. So, for an expat like you and me, this can be a good option. You can sign up with Getsafe with my referral link and ensure 15€ starting bonus.

Sources

- https://www.verbraucherzentrale.de/wissen/geld-versicherungen/weitere-versicherungen/private-haftpflichtversicherung-ein-absolutes-muss-fuer-jeden-13891

- https://www.settle-in-berlin.com/personal-liability-insurance-germany/

Disclaimer

This blog is only for educational purposes and all the opinions are my own entirely. Please do your own research and due diligence before making any financial decision. Some links may be affiliated, meaning using which we may get a small commission without any additional cost to you.

Leave a Reply