If you live or work in Germany, you will need to know two important numbers related to taxes: the Steueridentifikationsnummer (Tax ID) and the Steuernummer (Tax Number). These numbers are essential for handling tax-related matters, including employment, freelancing, and business operations.

Difference Between Tax ID and Tax Number

What is the Tax ID (Steueridentifikationsnummer)?

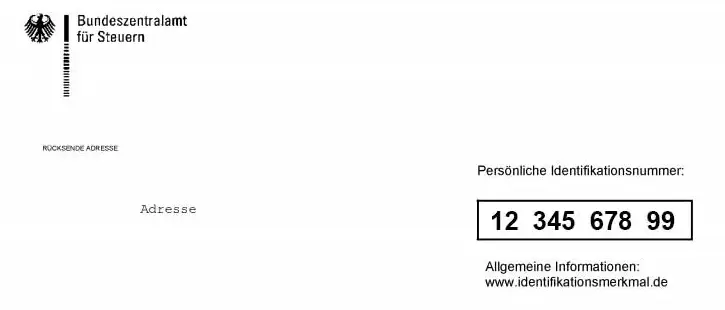

The Tax ID is an 11-digit number assigned to individuals by the Federal Central Tax Office (Bundeszentralamt für Steuern – BZSt). It remains with you for life, regardless of where you move within Germany. You need the Tax ID for:

- Registering with an employer

- Filing tax returns

- Opening a bank account

- Applying for social benefits

What is the Tax Number (Steuernummer)?

The Tax Number is a 10- to 11-digit number assigned by your local tax office (Finanzamt). Unlike the Tax ID, this number may change if you move to a different city or region. If you are a freelancer or run a business, you will receive a separate Tax Number to use for invoicing and tax declarations.

How to Get a Tax ID in Germany

For New Residents or Foreigners

If you are moving to Germany, you will receive your Tax ID automatically by mail within two to four weeks after registering your address at the Einwohnermeldeamt (residents’ registration office). You do not need to apply separately.

For Newborns in Germany

If your child is born in Germany, they will receive their Tax ID automatically by mail within a few weeks after birth.

How to Get a Tax Number in Germany

If you are employed, your employer will handle tax-related paperwork using your Tax ID. However, if you are self-employed or a freelancer, you need to apply for a Tax Number at your local Finanzamt (tax office) by submitting a Fragebogen zur steuerlichen Erfassung (Tax Registration Form). This can be done online via ELSTER (the German tax portal).

What to Do If You Lost Your Tax ID?

If you cannot find your Tax ID, you can:

- Check old documents such as your income tax statement (Einkommensteuerbescheid) or payslip (Lohnabrechnung).

- Request a new copy from the Federal Central Tax Office (BZSt) online or by mail.

- Visit your local Finanzamt with your passport and request it in person.

Note: The processing time for a new Tax ID request can take several weeks.

Where to Find Your Tax ID or Tax Number?

- Your Tax ID is found on official documents like your income tax notice, payslip, or social security card.

- Your Tax Number appears on your tax assessment notice or official tax-related correspondence from the Finanzamt.

Conclusion

Understanding and keeping track of your Tax ID and Tax Number is essential for managing taxes in Germany. The Tax ID is permanent and assigned by the Federal Central Tax Office, while the Tax Number is issued by your local tax office and may change when you relocate. Always keep these numbers safe and accessible for future tax-related matters.

Frequently Asked Questions

Where can I find my German Tax ID?

Your Tax ID is sent to you by mail after registering your address. If you lose it, you can request a copy from the Federal Central Tax Office.

Can I retrieve my German Tax ID online?

Currently, you cannot retrieve it instantly online, but you can request a duplicate via the BZSt website.

Can I obtain my Tax Number online in Germany?

Freelancers and self-employed individuals can apply for a Tax Number online via ELSTER.

What should I do if I cannot find my Tax ID or Tax Number?

You can check official documents or request a replacement from the respective tax authority.

Can I use my Tax ID and Tax Number interchangeably?

No, the Tax ID is used for personal tax identification, while the Tax Number is linked to your local tax office and is often required for business transactions.

For more guides on German bureaucracy, keep navigating through GermanySupport.de!

Leave a Reply