Simplify Your Tax Journey with ELSTER – Germany’s Online Tax Office

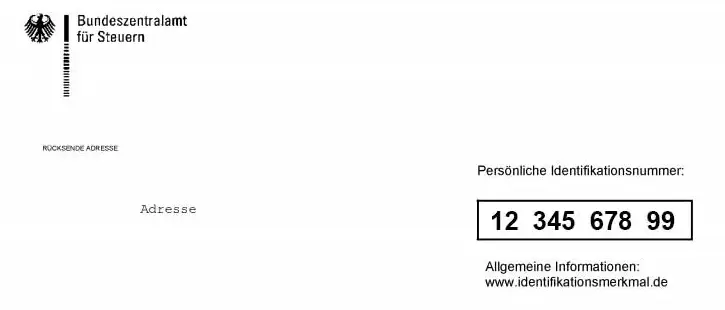

For many expatriates living and working in Germany, ELSTER is the go-to platform for managing tax returns online. This is particularly crucial for freelancers and self-employed individuals. What is ELSTER (Elektronische Steuererklärung)? ELSTER (ELektronische STeuerERklärung, meaning “electronic tax declaration”) is an online tax filing system developed by the Federal Central Tax Office (Bundeszentralamt für Steuern).…